Subscribe to Our Newsletter

[email-subscribers-form id=”1″]

![]()

Don't forget to log out before exiting the page.

Logout

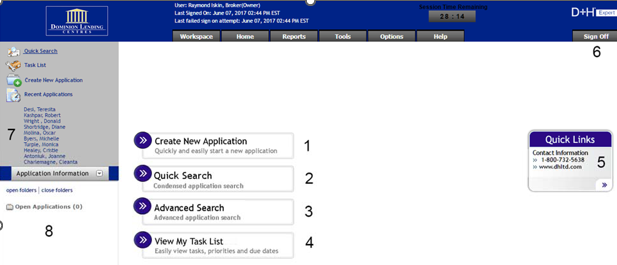

This is the main page you’ll see when logging into Filogix and it provides the following options.

Want to receive push notifications for all major on-site activities?